Cash Flow

February 15, 2014

Consumers And Contributors

It’s a consumer economy. If consumer confidence goes down and people buy less, the economy slips. If consumer confidence improves and people buy more, the economy improves. That’s what they...

January 22, 2014

Budgets And Stick To Them

Just because you have a budget and planned your financials, doesn’t mean you’ll stick with it. In fact, entrepreneurs rarely do. What I have found to be effective though, is...

December 31, 2013

Never Confuse Income With Wealth

Never confuse significant income with significant wealth. Never confuse activity with efficiency, nor efficiency with productivity. Never confuse workaholism with actual results. Forever spend less than you make, and significant...

November 21, 2013

A Lesson In Profit First: How Healthy Is Your Business?

As I conducted interviews for Profit First, I found a scary trend. Of the 300+ entrepreneurs I spoke with for this book, most are quick to share - scratch that,...

September 30, 2013

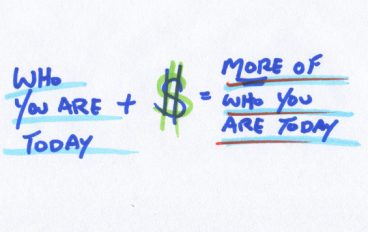

Money Amplifies Your Addictions

Money is not good. Money is not bad. Money let's you do more. Be more. Act more. Money amplifies who you are. If you are addicted to drugs. Money will...

September 29, 2013

How To Measure The Health Of Your Business Instantly

I suspect you don't check your income statement every day. You likely don't check it weekly either. Maybe you check it monthly. Maybe. But probably not. For many entrepreneurs the...

September 20, 2013

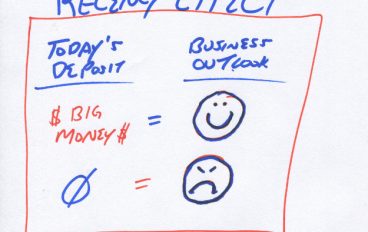

The Entrepreneurs's Distorted View Of The Financials

Ask any small business owner how business is going and they will tell you how it has been the last week or two. Maybe even the last month. Business will...

September 17, 2013

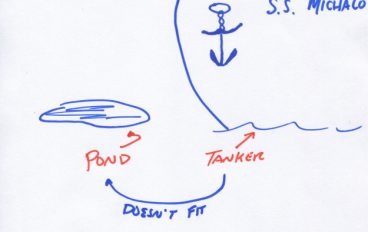

Don't Build A Tanker For A Pond

My phone rang this weekend and on the other end was Ed. Ed and I have known each other since the high school days. After college, I started my entrepreneurial...

September 8, 2013

Fixed Costs Aren't Fixed

They say fixed costs are things that can't go away. Buildings, machinery, alimony (that last one is a joke, people). They lie. Fixed costs don't really exist. For example, if...

August 22, 2013

The 10th & 24th Rule For Cash Flow Management

When does your company pay bills? When you have the cash? When your bookkeeper gets around to it? When you get a collections notice? Paying sporadically prevents you from ever...